Apr 25, 2023

Ad hoc announcement pursuant to Art. 53 LR

Strategy Update

Our focus

With our new focused strategy unveiled in 2022, Novartis is transforming into a “pure-play” Innovative Medicines business. We have a clear focus on five core therapeutic areas (cardiovascular, immunology, neuroscience, solid tumors and hematology), with multiple significant in-market and pipeline assets in each of these areas, that address high disease burden and have substantial growth potential. In addition to two established technology platforms (chemistry and biotherapeutics), three emerging platforms (gene & cell therapy, radioligand therapy, and xRNA) are being prioritized for continued investment into new R&D capabilities and manufacturing scale. Geographically, we are focused on growing in our priority geographies - the US, China, Germany and Japan.

Our priorities

Sandoz planned spin-off

The planned spin-off remains on track for the second half of 2023. Completion of the transaction is subject to certain conditions, including consultation with works councils and employee representatives (as required), general market conditions, tax rulings and opinions, final Board of Directors endorsement and shareholder approval in line with Swiss corporate law. The transaction is expected to be tax neutral to Novartis.

Financials

First quarter

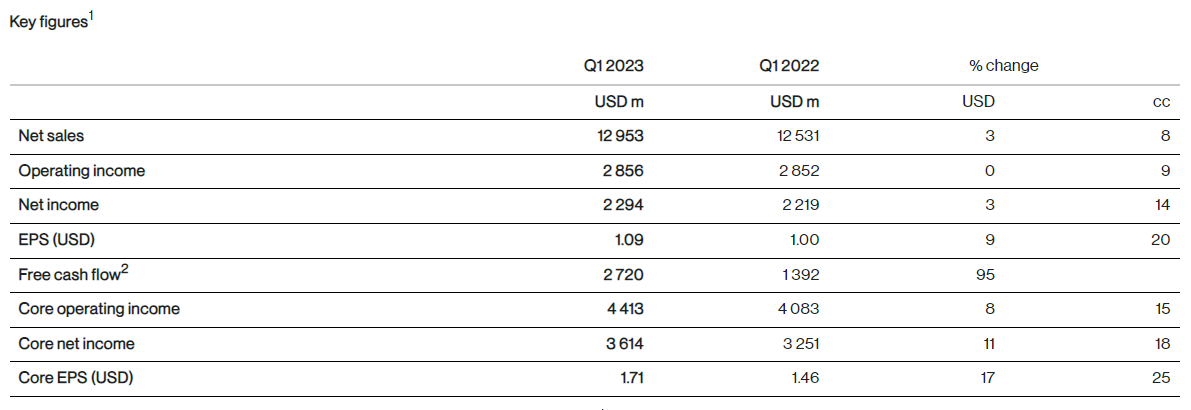

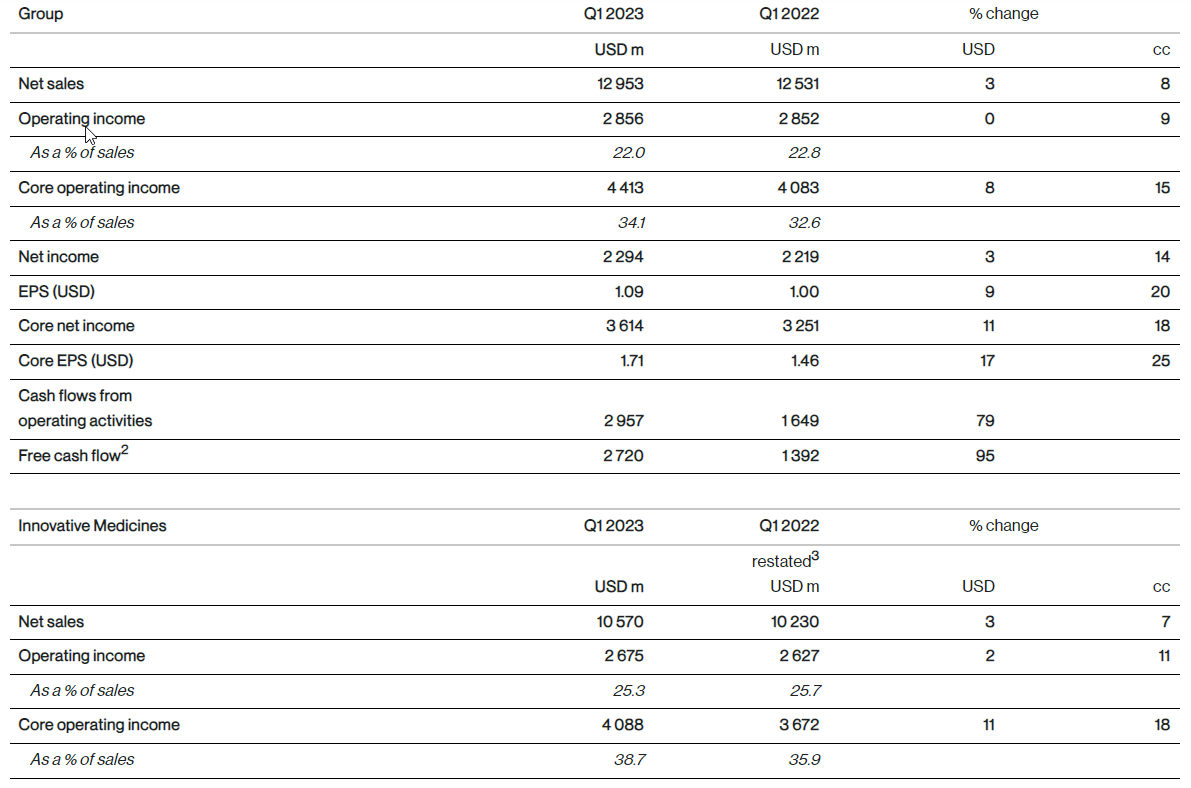

Net sales were USD 13.0 billion (+3%, +8% cc) in the first quarter driven by volume growth of 16 percentage points, price erosion of 4 percentage points and the negative impact from generic competition of 4 percentage points.

Operating income was USD 2.9 billion (0%, +9% cc), mainly driven by higher sales. Other income from legal matters was more than offset by higher restructuring and impairment charges.

Net income was USD 2.3 billion (+3%, +14% cc), mainly due to higher operating income and higher interest income.

EPS was USD 1.09 (+9%, +20% cc), growing faster than net income, benefiting from lower weighted average number of shares outstanding.

Core operating income was USD 4.4 billion (+8%, +15% cc). Core operating income margin was 34.1% of net sales, increasing by 1.5 percentage points (+2.2 percentage points cc).

Core net income was USD 3.6 billion (+11%, +18% cc), mainly due to higher core operating income and higher interest income.

Core EPS was USD 1.71 (+17%, +25% cc), growing faster than core net income, benefiting from lower weighted average number of shares outstanding.

Free cash flow amounted to USD 2.7 billion (+95% USD), compared to USD 1.4 billion in the prior year quarter, mainly due to higher operating income adjusted for non-cash items and favorable changes in working capital.

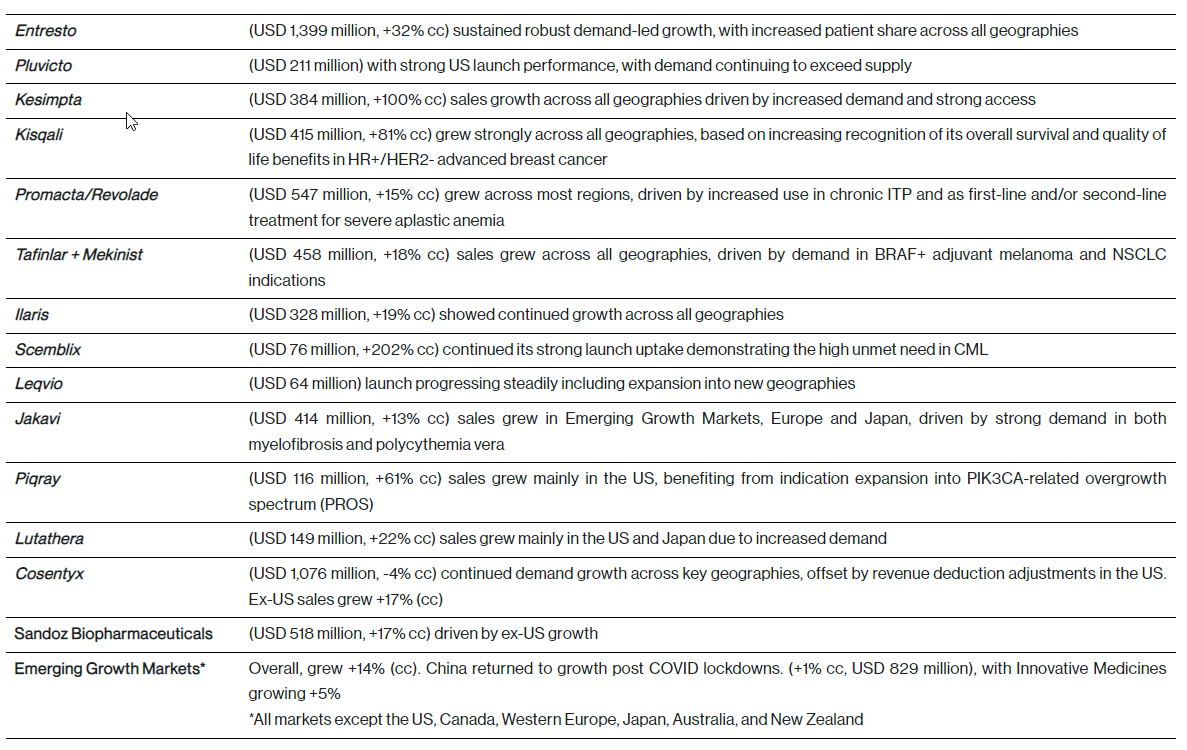

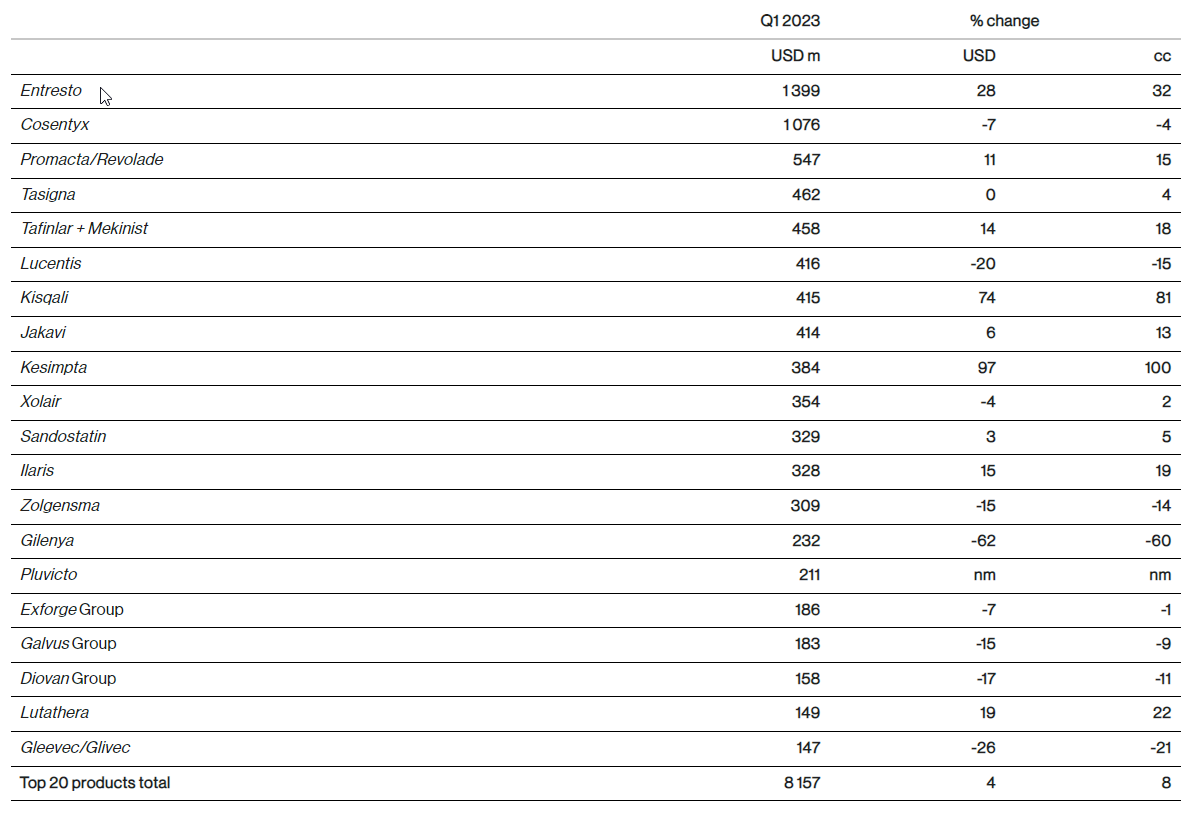

Innovative Medicines net sales were USD 10.6 billion (+3%, +7% cc), with volume contributing 16 percentage points to growth. Sales growth was mainly driven by Entresto, Pluvicto, Kesimpta and Kisqali partly offset by generic competition mainly for Gilenya. Generic competition had a negative impact of 5 percentage points. Pricing had a negative impact of 4 percentage points. Sales in the US were USD 4.1 billion (+11%) and in the rest of the world were USD 6.5 billion (-1%, +5% cc).

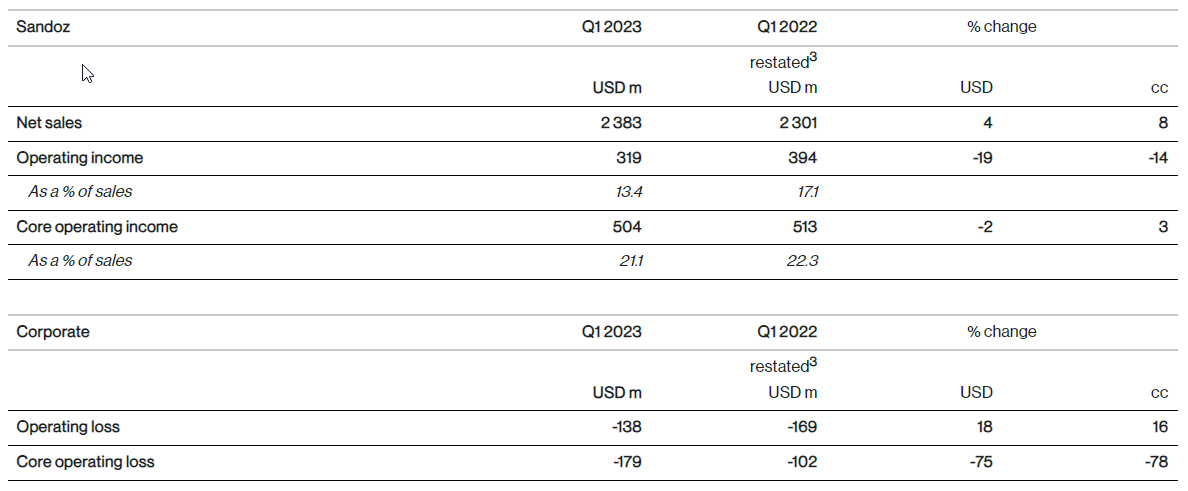

Sandoz net sales were USD 2.4 billion (+4%, +8% cc), with volume contributing 15 percentage points to growth. Sales growth was mainly driven by Europe, which benefited from strong volume growth driven by continued momentum from prior year launches and a strong cough and cold season. Pricing had a negative impact of 7 percentage points. Ex-US sales grew by +12% in cc. Global sales of Biopharmaceuticals grew to USD 518 million (+11%, +17% cc), driven by ex-US growth.

Q1 key growth drivers

Underpinning our financial results in the quarter is a continued focus on key growth drivers including:

Net sales of the top 20 Innovative Medicines products in Q1 2023

nm= not meaningful

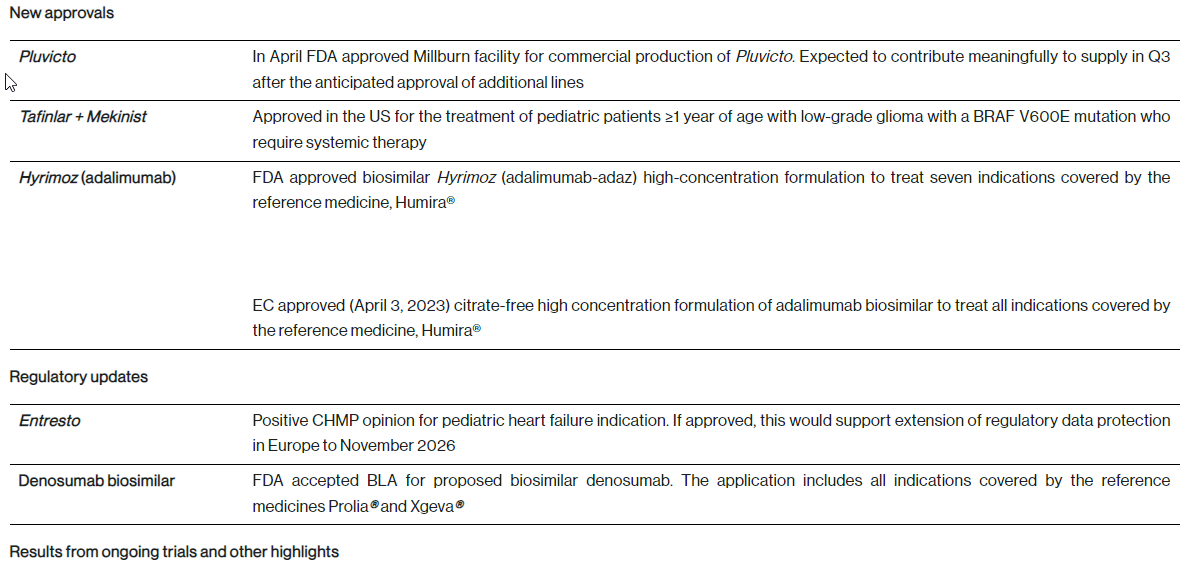

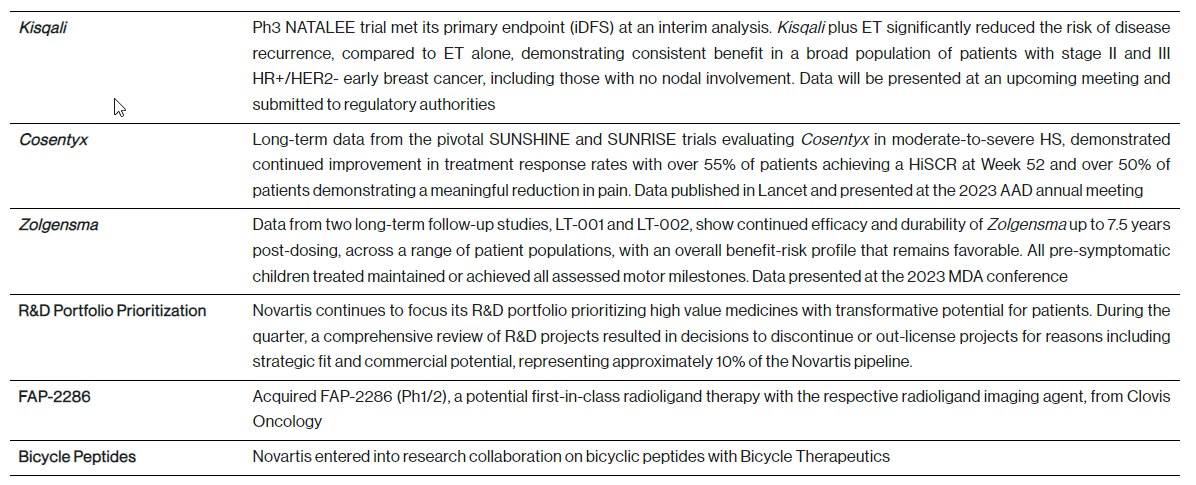

R&D update - key developments from the first quarter

Capital structure and net debt

Retaining a good balance between investment in the business, a strong capital structure and attractive shareholder returns remains a priority.

In Q1 2023, Novartis repurchased a total of 31.5 million shares for USD 2.8 billion on the SIX Swiss Exchange second trading line under the up-to USD 15 billion share buyback announced in December 2021. In addition, 1.2 million shares (for an equity value of USD 0.1 billion) were repurchased from associates. In the same period, 10.5 million shares (for an equity value of USD 0.3 billion) were delivered as a result of options exercised and share deliveries related to participation plans of associates. Novartis aims to offset the dilutive impact from equity based participation plans of associates over the remainder of the year. Consequently, the total number of shares outstanding decreased by 22.2 million versus December 31, 2022. These treasury share transactions resulted in an equity decrease of USD 2.5 billion and a net cash outflow of USD 2.7 billion.

As of March 31, 2023, net debt increased to USD 15.1 billion compared to USD 7.2 billion at December 31, 2022. The increase was mainly due to the USD 7.3 billion annual dividend payment and net cash outflow for treasury share transactions of USD 2.7 billion, partially offset by USD 2.7 billion free cash flow in Q1 2023.

As of Q1 2023, the long-term credit rating for the company is A1 with Moody’s Investors Service and AA- with S&P Global Ratings.

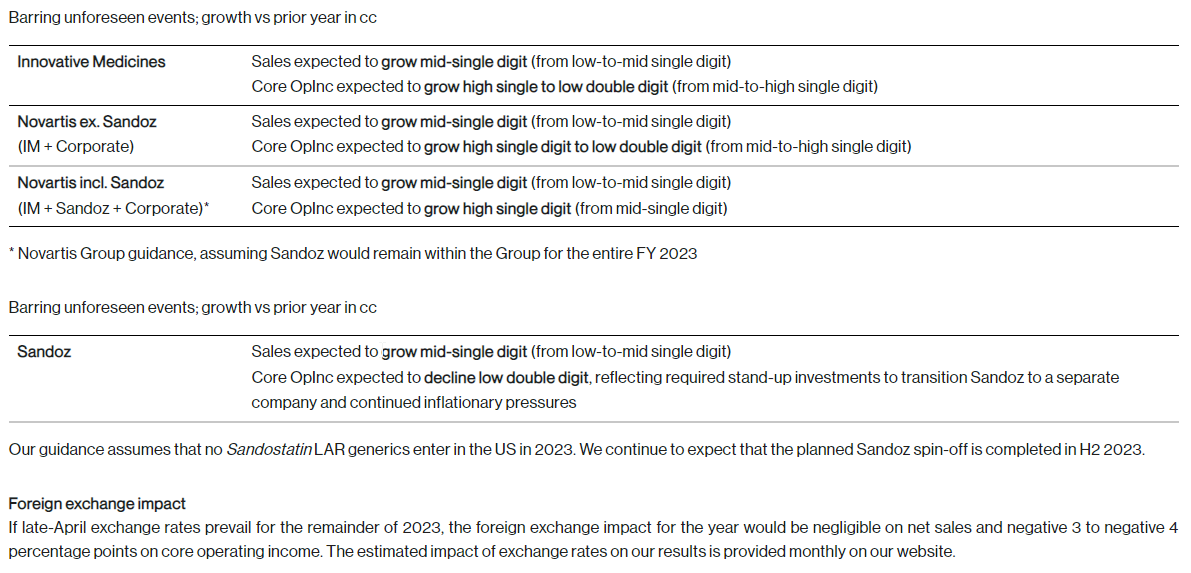

2023 outlook raised due to strong growth momentum

Key figures1

1Constant currencies (cc), core results and free cash flow are non-IFRS measures. An explanation of non-IFRS measures can be found on page 35 of the Condensed Interim Financial Report. Unless otherwise noted, all growth rates in this Release refer to same period in prior year.

2To aid in comparability, the prior year free cash flow amounts have been revised to conform with the new free cash flow definition that was effective as of January 1, 2023.

3 Restated to reflect the transfers of the Sandoz division’s biotechnology manufacturing services to other companies’ activities and the Coartem brand to the Innovative Medicines division that was effective as of January 1, 2023 (see Note 9 of the Condensed Interim Financial Report).

Detailed financial results accompanying this press release are included in the Condensed Interim Financial Report at the link below:

https://ml-eu.globenewswire.com/resource/download/c0540159-3aae-4e2d-9a9b-97f92af073e3/

Disclaimer

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, that can generally be identified by words such as “continue,” “progresses,” “remain,” “growth,” “on track,” “confidence,” “upcoming,” “prioritizing,” “expect,” “continued,” “ongoing,” “optimistic,” “outlook,” “focus,” “pipeline,” “growth,” “potential,” “expected,” “will,” “guidance,” “continuing,” “estimated,” “launch,” “continue,” “to deliver,” “transformation,” “address,” “growing,” “accelerate,” “remains,” “scaling,” “expected,” “driven,” “long-term,” “innovation,” “transformative,” “priority,” “can,” “to develop,” “to experience,” “look forward,” “momentum,” or similar expressions, or by express or implied discussions regarding potential new products, potential new indications for existing products, potential product launches, or regarding potential future revenues from any such products; or regarding potential future, pending or announced transactions; or regarding the research collaboration with Bicycle Therapeutics; or regarding potential future sales or earnings of the Group or any of its divisions; or regarding discussions of strategy, priorities, plans, expectations or intentions, including our transforming into a “pure-play” Innovative Medicines business; or regarding the Group’s liquidity or cash flow positions and its ability to meet its ongoing financial obligations and operational needs; or regarding our planned spin-off of Sandoz. Such forward-looking statements are based on the current beliefs and expectations of management regarding future events and are subject to significant known and unknown risks and uncertainties. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those set forth in the forward-looking statements. You should not place undue reliance on these statements. In particular, our expectations could be affected by, among other things: liquidity or cash flow disruptions affecting our ability to meet our ongoing financial obligations and to support our ongoing business activities; the impact of a partial or complete failure of the return to normal global healthcare systems including prescription dynamics; global trends toward healthcare cost containment, including ongoing government, payer and general public pricing and reimbursement pressures and requirements for increased pricing transparency; uncertainties regarding potential significant breaches of data security or data privacy, or disruptions of our information technology systems; regulatory actions or delays or government regulation generally, including potential regulatory actions or delays with respect to the development of the products described in this press release; the potential that the benefits and opportunities expected from our planned spin-off of Sandoz may not be realized or may be more difficult or take longer to realize than expected; the uncertainties in the research and development of new healthcare products, including clinical trial results and additional analysis of existing clinical data; our ability to obtain or maintain proprietary intellectual property protection, including the ultimate extent of the impact on Novartis of the loss of patent protection and exclusivity on key products; safety, quality, data integrity, or manufacturing issues; uncertainties involved in the development or adoption of potentially transformational technologies and business models; uncertainties regarding actual or potential legal proceedings, investigations or disputes; our performance on environmental, social and governance measures; general political, economic and business conditions, including the effects of and efforts to mitigate pandemic diseases such as COVID-19; uncertainties regarding future global exchange rates; uncertainties regarding future demand for our products; and other risks and factors referred to in Novartis AG’s current Form 20-F on file with the US Securities and Exchange Commission. Novartis is providing the information in this press release as of this date and does not undertake any obligation to update any forward-looking statements as a result of new information, future events or otherwise.

All product names appearing in italics are trademarks owned by or licensed to Novartis Group companies. Humira® is a registered trademark of Abbvie Biotechnology Ltd. Prolia® and Xgeva® are registered trademarks of Amgen Inc. Jakafi® is a registered trademark of Incyte Corporation.

About Novartis

Novartis is reimagining medicine to improve and extend people’s lives. We deliver high-value medicines that alleviate society’s greatest disease burdens through technology leadership in R&D and novel access approaches. In our quest to find new medicines, we consistently rank among the world’s top companies investing in research and development. About 103,000 people of more than 140 nationalities work together to bring Novartis products to nearly 800 million people around the world. Find out more at https://www.novartis.com.

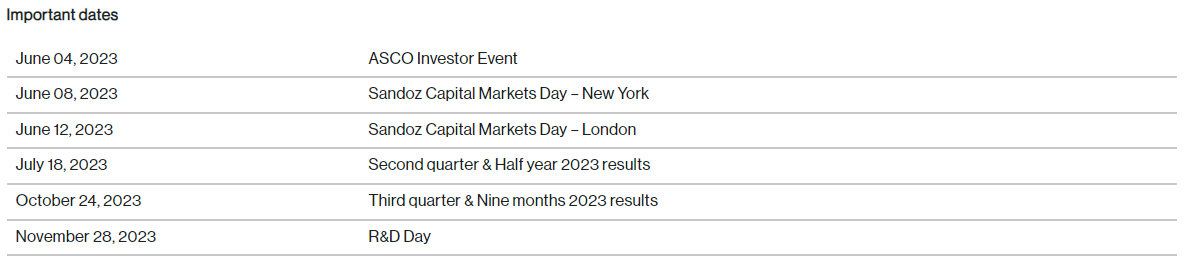

Novartis will conduct a conference call with investors to discuss this news release today at 14:00 Central European time and 8:00 Eastern Time. A simultaneous webcast of the call for investors and other interested parties may be accessed by visiting the Novartis website. A replay will be available after the live webcast by visiting https://www.novartis.com/investors/event-calendar.

Detailed financial results accompanying this press release are included in the condensed interim financial report at the link below. Additional information is provided on Novartis divisions and pipeline of selected compounds in late stage development and a copy of today's earnings call presentation can be found at https://www.novartis.com/investors/event-calendar.

1 Constant currencies (cc), core results and free cash flow are non-IFRS measures. An explanation of non-IFRS measures can be found on page 35 of the Condensed Interim Financial Report. Unless otherwise noted, all growth rates in this Release refer to same period in prior year. 2 Effective January 1, 2023, Novartis revised its definition of free cash flow, to define free cash flow as net cash flows from operating activities less purchases of property, plant and equipment. To aid in comparability, the prior year free cash flow amounts have been revised to conform with the new free cash flow definition. See page 35 of the Condensed Interim Financial Report. 3 Please see detailed guidance assumptions on page 6.

Please find full media release in English attached and on the following link:

Further language versions are available through the following links:

German version is available through the following link:

French version is available through the following link:

Original source can be found here.